Last month, our team showed off a shiny new stablecoin dashboard at the Monetary Authority of Singapore's pavillion at Singapore FinTech Festival 🇸🇬

(It actually shines...check the photo if you don't believe me.)

3 quick insights from the data:

1. Singaporean stablecoin flows are institution-dominated, even more than global. Institutions account for ~15% of transactions (90k out of 573k in the last 6 months)—but 99.5% of total volume ($73.1B out of $73.5B). Globally, institutions drive 95% of volume.

2. In Singapore, merchants move 2.5x more volume than individuals - $279M vs $56M.

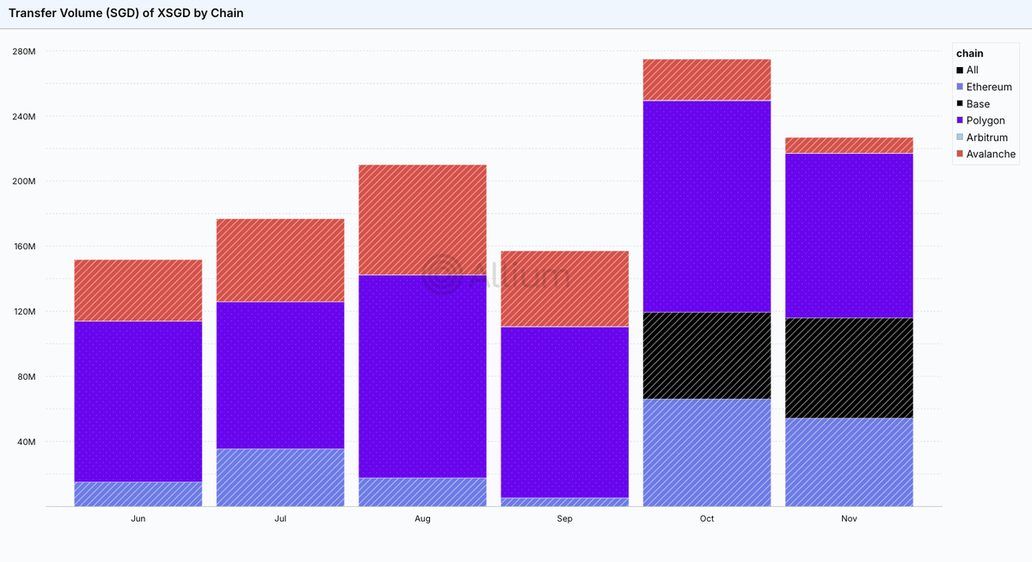

3. USDC dominates transfers, but we're also tracking XSGD—Singapore's first SGD-denominated stablecoin. It recently hit over $200M in monthly transfer volume. (excited to see this number tick up!)

🔗 Full writeup on what we built and how:

3.42K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.